Blue Care Epo Gold Kansas Health Markets Com

In Kansas, cheap health insurance plans are available for purchase through the state's marketplace. And depending on your household income, you might qualify for health insurance through Medicaid.

For 2022, the average health insurance cost in Kansas is $525 for a 40-year-old. This is an increase of 11% compared to the 2021 plan year.

We researched all of the health insurance plans in Kansas to help you find your best health insurance coverage. Depending on the county you live in, either the Ambetter Balanced Care 12 or the BlueCare EPO Silver Plus is the cheapest Silver plan available. However, the cost of a policy will vary significantly by region, and depending on your needs, you may want to buy a plan in a different metal tier.

Select a plan tier to learn more:

Read on to learn about the cheapest plans by plan tier, the cheapest plans by location and how the cost of health insurance changes depending on family size.

- Cheapest health insurance coverage by plan tier

- Health insurance rate changes in Kansas

- Short-term health insurance in Kansas

- Best cheap health insurance companies in Kansas

- Cheapest Silver plan by county

- Average cost of health insurance by family size

We analyzed health insurance plans in Kansas by plan tier to identify which policies are the best for each degree of coverage. Depending on which county you live in, the insurers and health plans listed below may not be offered in your area. However, these plans are a good starting point in comparing the costs and benefits you can expect from different levels of coverage.

| Plan tier | Cheapest plan | Monthly cost | Deductible | Out-of-pocket maximum |

|---|---|---|---|---|

| Catastrophic | Medica with Healthier You Catastrophic | $286 | $8,700 | $8,700 |

| Bronze | Ambetter Essential Care 1 | $332 | $8,600 | $8,600 |

| Bronze Expanded | Ambetter Essential Care 2 HSA | $363 | $6,900 | $6,900 |

| Silver | Ambetter Balanced Care 12 | $447 | $6,500 | $8,400 |

| Gold | Ambetter Secure Care 20 | $451 | $750 | $7,500 |

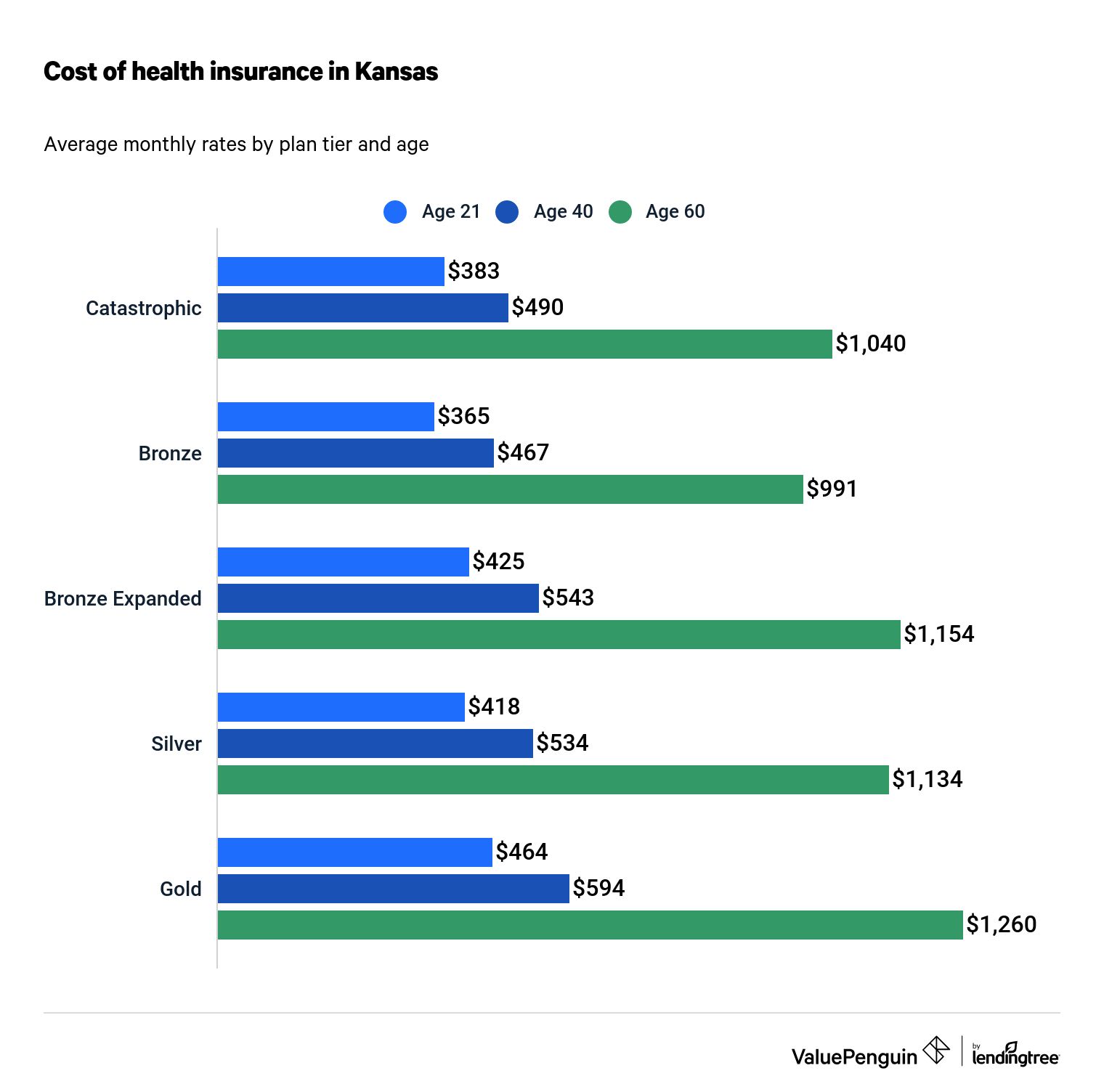

Two important factors in determining insurance premiums are metal tier and age. Higher metal tiers offer lower out-of-pocket costs, which means you'll pay less if you need to use your health insurance, but this also means you'll pay higher monthly premiums.

Age also plays a large role in determining health insurance rates — as you get older, premiums become more expensive. As you can see below, a 40-year-old in Kansas would pay $116 per month more on average than a 21-year-old on a Silver plan.

Finding your best health insurance coverage in Kansas

Available insurers change by county, so the best cheap health insurance plan available to you in Kansas will depend on where you live and the level of coverage you choose.

Higher metal tier health plans, like Gold policies, have monthly premiums that are not as cheap as Silver policy premiums but have significantly lower out-of-pocket expenses, like deductibles, copays and coinsurance. So, if you have costly prescriptions or are worried about the high costs of an unexpected illness, a higher metal tier plan will probably be your best health insurance choice.

On the other hand, if you are young and healthy, or have no expected medical costs and want to keep your monthly rates down, a lower metal tier plan may be a good option.

Gold plans: Best for people who expect high medical costs

Gold health insurance plans have the lowest costs if you need to use your insurance often since Gold plans may have lower deductibles and copays. However, the monthly premium you can expect to pay may be higher. Therefore, these health plans are best if you have high expected medical costs, such as ongoing prescriptions, or you are concerned about being able to pay out of pocket for an unexpected condition.

The cheapest Gold plan in Kansas is the Ambetter Secure Care 20. Compare all tiers in Kansas above.

Silver plans: Best for people with average medical costs or low incomes

A Silver health plan may be best if you would like a policy that has lower out-of-pocket costs than a Bronze plan but a more affordable monthly premium than a Gold plan. These plans are also eligible for cost-sharing subsidies, which lower your out-of-pocket expenses if you are part of a lower-income household.

The cheapest Silver plan in Kansas is the Ambetter Balanced Care 12. Compare all tiers in Kansas above.

Bronze and Catastrophic plans: Best for young people

Catastrophic and Bronze plans offer an affordable alternative to Silver and Gold plans, as their monthly premiums are less expensive. However, Catastrophic plans are only available to those who are under 30 or qualify for an exemption.

It's important to note that if you are covered under a Catastrophic health plan, you cannot use a premium tax credit to reduce your cost.

Bronze plans are available to everyone, and these lower metal tier policies have cheap monthly premiums for health insurance — but they come with much higher deductibles. So, if you need medical care during the year, you have to pay more money out of pocket before coverage kicks in.

If you can cover the high cost-sharing in the event of an emergency and expect to have low medical costs, a Bronze plan may be your best low-cost option for health insurance coverage.

The cheapest Bronze plan in Kansas is the Ambetter Essential Care 1. The cheapest Catastrophic plan is the Medica with Healthier You Catastrophic. Compare all tiers in Kansas above.

Health insurance rate changes in Kansas

Health insurance rates are set yearly by insurance providers and then approved by federal regulators for the following plan year.

For 2022, Catastrophic plans experienced the largest increase in costs — rising 35% compared to 2021. On the other hand, Silver plans are 1% cheaper for 2022.

| Plan tier | 2020 | 2021 | 2022 | 2022 vs. 2021 |

|---|---|---|---|---|

| Catastrophic | $371 | $364 | $490 | 35% |

| Bronze | $382 | $437 | $467 | 7% |

| Bronze Expanded | $426 | $464 | $543 | 17% |

| Silver | $497 | $539 | $534 | -1% |

| Gold | $655 | $572 | $594 | 4% |

Monthly rates are based on a 40-year-old adult.

Short-term health insurance in Kansas

Short-term health insurance is offered by insurance providers with limited restrictions in Kansas. These plans follow federal guidelines with maximum coverage periods of up to one year. However, you can only renew short-term health insurance coverage one time and not for 36 months like in some other states.

In Kansas, short-term health plans do not necessarily cover the essential health benefits, and they require medical underwriting. For this reason, you should be careful when selecting short-term health insurance as your primary health care coverage.

Find Cheap Health Insurance Quotes in Your Area

Best cheap health insurance companies in Kansas

There are five health insurance companies on the Kansas state exchange, but only Medica Insurance Co. is available in every county.

- Blue Cross and Blue Shield of Kansas Inc.

- Celtic Insurance Co.

- Cigna Health and Life Insurance Co.

- Medica Insurance Co.

- Oscar Insurance Co.

When searching for the best health insurance for you, we recommend starting with Blue Cross and Blue Shield of Kansas Inc. or Ambetter/Celtic Insurance Co., as they typically provide the cheapest Silver health plan in the counties where they are available.

Cheapest health insurance plan by county

To help you get started in your search for the best health plan, we identified the most affordable Silver health insurance policies available on the state exchange by county. Below, you can see which policy has the best rate for your county, as well as some sample monthly premiums for individuals and families.

| County name | Cheapest Silver plan | Age 40 | Couple, age 40 | Couple, age 40 & child |

|---|---|---|---|---|

| Allen | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Anderson | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Atchison | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Barber | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Barton | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Bourbon | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Brown | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Butler | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Chase | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Chautauqua | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Cherokee | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

| Cheyenne | Ambetter Balanced Care 12 | $447 | $893 | $1,161 |

Show All Rows

Average cost of health insurance by family size in Kansas

Depending on the size of a family, health insurance rates change based on the number of individuals who need coverage and their ages. Children below the age of 15 qualify for lower health insurance premiums, which remain flat. But once a child reaches the age of 15, the premium will increase each year as they grow older.

For example, the average cost of health insurance for a family of three is $1,387 in Kansas, assuming two 40-year-old parents and a child. For each additional child, the average cost of a Silver health plan increases by around $320, so a family of four (two 40-year-olds and two children) would cost an average of $1,707 per month to insure.

| Family size | Average cost |

|---|---|

| Individual and child | $853 |

| Couple, age 40 | $1,068 |

| Family of three (adult couple and a child) | $1,387 |

| Family of four (adult couple and two children) | $1,707 |

| Family of five (adult couple and three children) | $2,026 |

Adults are assumed to be 40 years old. Children are assumed to be 14 or younger. Sample rates are based on the average monthly cost of a Silver plan in Kansas.

Methodology

The health insurance rate and policy data used in this analysis was from Centers for Medicare & Medicaid Services (CMS) documents. ValuePenguin used the CMS Public Use Files (PUFs) to get average state premiums across a variety of factors such as metal tier, county and family size. Plans and providers for which county-level data was included in the CMS Crosswalk file were used in our analysis; those excluded from this dataset may not appear.

Source: https://www.valuepenguin.com/best-cheap-health-insurance-kansas

0 Response to "Blue Care Epo Gold Kansas Health Markets Com"

Postar um comentário